Achieve a Holistic Estate Plan to create Generational Wealth in just 2 Months

Without Complicated & Time Wasting Legal Procedures

WHO AM I ?

Hi, it's Edmond, and I've helped over 200 familes achieve a Holistic Estate Plan over the past 17 years. This ensures their assets are distributed according to their wishes so they can achieve Generational Wealth and peace of mind with my Systematic 9-Step Estate Planning Framework.

My professional qualifications includes Associate Specialist in Estate Planning (ASEP®) and Associate Financial Planner (AFPCM), and I have been awarded top 10% of financial advisors globally.

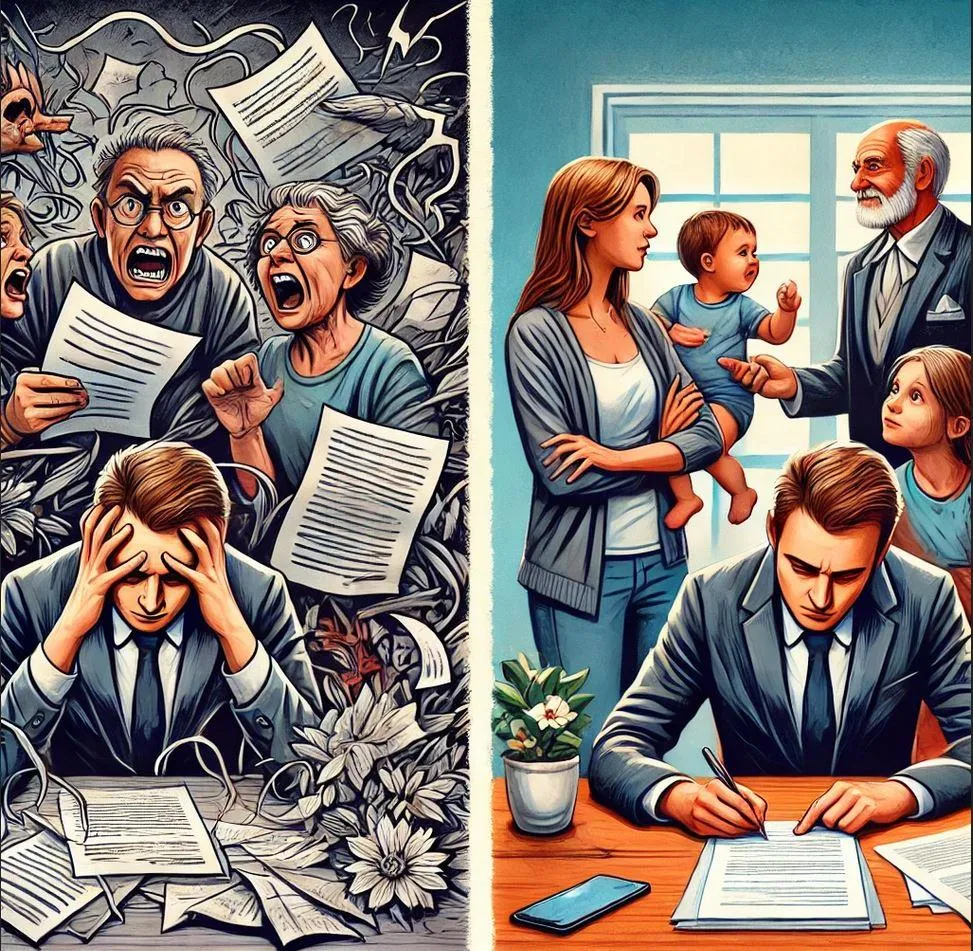

The Problem With Not Having an Estate Plan

⚖️ Your estate will be distributed according to the Singapore Intestate Succession Act

🦈 Your estate may also fall into the hands of creditors

💔 Destroy your family's harmony when your beneficiaries fight over their rights of your inheritance

💸 Distribution of your assets might involve fees that can be costly

❄️ Assets might be frozen

⏳ Longer or delayed settlement

😈 Your child may be raised by someone you do not trust

I've seen countless professionals and business owners struggle with not having an estate plan and the resulting lack of a clear roadmap to pass down their wealth to their families.

As a result, it leads to family disputes, delay in the distribution of assets, and additional legal fees.

I know how frustrating this can be, and I want to help.

A Clear Estate Plan Should Have the following:

💼 Identification of Assets: Determine what assets you have, where they are located, how they are held, and who holds them with you

📝 Clear Distribution Plan: Specify what, when, and how you want to distribute your wealth to your beneficiaries

💰 Lump Sum vs. Staggered Distribution: Decide whether to distribute your wealth in a lump sum or over a period of time

👶 Guardian and Trustee for Minor Children: Identify guardian(s) and trustee(s) for your minor children

🛡️Asset Protection: Implement strategies to safeguard your assets from potential creditors, lawsuits, matrimonial disputes and other risks.

⚠️ Potential Trustee Issues: Be aware of possible problems when the trustee is a person, such as misappropriation of funds, conflicts of interest, and poor financial decisions that may not align with your children’s best interests

JUST WRITING A SIMPLE WILL DOES NOT MEAN YOU HAVE AN ESTATE PLAN

In fact, a simple will may give you more problems than NOT having will at all.

That's why I've created the Systematic 9-Step Estate Planning Framework – a proven solution that tackles the core issues affecting not having an estate plan. This allows you to create a Holistic Estate Plan to not just ensure your assets are smoothly distributed according to your wishes, but also to maximise and optimise your estate. This crucial step helps to create Generational Wealth in the shortest time possible.

Don't let not having an estate plan hold you back any longer. Sign up for a consultation at our limited time promotional rates today and take your first step towards creating a Holistic Estate Plan!

What Will You Be Getting:

💎Personalized Estate Plan: A comprehensive and customized estate plan that reflects your unique wishes and needs.

🌟 Peace of Mind: Confidence knowing your loved ones are protected and your assets are distributed according to your wishes

💰 Estate Optimisation: Strategies designed to optimise and maximise the value of your estate

💎Creation of Generational Wealth: Empower your legacy by creating a foundation of lasting prosperity that supports your family for generations

👨💼 Expert Support: Continuous review to ensure that your Estate Plan is in line with your current goals and circumstances

🎁 Special Offer: Limited Time Only! For a limited time, I will be offering an Exclusive Estate Planning Package at a Special Discounted Rate

This package includes:

📊 Comprehensive analysis of your assets: $1,000

📋 Analysis of your existing insurance plans: $500

📈 Executive Summary: $2,000

📝 Will: $300

💬 Consultation Fees: From $200/hour

**Total Value: $4,800**

💰 Usual Price:

$2,999

🚀 Price Now: From $300 🚀

As this is a time-intensive 1-1 consultation, it is by application approval only.

Our team will review your application and reach out if your application has been approved

🌟Debunking Common Misconceptions About Estate Planning🌟

Estate and trust planning is often misunderstood, leading to missed opportunities and potential pitfalls. Here are some common misconceptions:

"I Don’t Need an Estate Plan; I’m Not Wealthy"

Estate planning isn’t just for the wealthy. It’s about ensuring your assets, whether large or small, are distributed according to your wishes. Proper planning can also prevent legal disputes and provide for loved ones.

"DIY Wills Are Just as Good as Professional Ones"

While DIY templates are tempting, they often lack the customization needed for complex situations and may not comply with legal standards. Professional guidance ensures your will is legally sound and reflective of your true intentions.

"Trusts Are Only for the Ultra-Rich"

Trusts offer benefits beyond tax savings. They provide asset protection, ensure confidentiality, and allow for controlled distribution over time, making them valuable tools for families of all financial backgrounds.

"Once My Estate Plan Is Done, It’s Set Forever"

An estate plan isn’t a one-time task. It should be regularly reviewed and updated to reflect changes in your life, such as marriage, the birth of a child, or changes in financial status.

"Naming a Family Member as Executor or Trustee Is Always Best"

While it might seem logical to choose a trusted family member, they may face emotional burdens, conflicts of interest, or lack the expertise needed to manage complex estates. Professional executors or trustees can provide impartiality and expertise.

"Estate Planning Is Only About Distributing Assets After Death"

Estate planning also includes preparing for incapacity, ensuring your medical and financial affairs are managed according to your wishes if you’re unable to do so. Strategies can be implemented to offer wealth protection for wealth transfer to your children, during your lifetime, protecting your wealth against spendthrift children, creditors, and distribution to an ex-child-in-law upon their divorce.

🌟The Benefits of Having an Estate Plan and Trust🌟

Creating an estate plan and establishing a trust are essential steps in safeguarding your assets and ensuring your wishes are honored. Here’s how they can help you:

Protect Your Loved Ones

An estate plan ensures your assets are distributed according to your wishes, providing financial security for your loved ones. It also helps avoid legal disputes and ensures that minor children have guardianship arrangements in place.

Avoid Probate Delays

A well-structured estate plan can help your heirs avoid the lengthy and costly probate process. Trusts, in particular, allow for the smooth and private transfer of assets, bypassing the need for court involvement.

Maintain Privacy and Confidentiality

Trusts offer a level of privacy that wills do not. While a will becomes public record during probate, the details of a trust remain confidential, keeping your financial affairs out of the public eye.

Reduce Taxes and Legal Fees

A strategic estate plan can minimize estate taxes and reduce legal fees, preserving more of your wealth for your beneficiaries. Trusts, in particular, can offer significant tax advantages.

Control Asset Distribution

Trusts allow you to control how and when your assets are distributed. Whether you want to provide for loved ones over time, protect beneficiaries from creditors, or ensure assets are used for specific purposes, a trust gives you that flexibility.

Create Generational Wealth

An estate plan and trust enable you to build and preserve wealth across generations. By setting up structures that protect your assets and ensure they are passed down efficiently, you can create a lasting legacy that benefits your children, grandchildren, and beyond.

Prepare for Incapacity

Estate planning isn't just about what happens after you’re gone. It also ensures that if you become incapacitated, your financial and healthcare decisions are managed according to your wishes through powers of attorney and advance medical directives.

Avoid Family Disputes

Clear instructions in your estate plan can help prevent misunderstandings and conflicts among family members, ensuring your legacy is protected and your wishes are respected.

OUR ESTATE PLANNING PARTNERS

Absolute Trust & Estate Pte Ltd

Barakah Capital Planners Pte Ltd

Characterist LLP

Chris Chong & CT Ho LLP

Falco Heritage Pte Ltd

Kensington Trust Group

Metis Global (Singapore) Pte Ltd

Precepts Legacy Pte Ltd

Vistra Trust (Singapore) Pte Limited

WHAT PEOPLE SAY ABOUT Me

“Ed has been my financial advisor since 2010 and he has consistently been dishing out sound financial and insurance advice. I have recommended his services to several of my close friends and family over the years and they have nothing but praise for his service. Ed often goes above and beyond to attend to my questions when it comes to various insurance products and their coverage, and will personally see to all of my claims processes. Highly recommended to those who wants a reliable, down to earth person to handle all your financial and insurance needs.”

Dr Ian Tan, MD

“I have known Edmond Goh since 2016 after my previous Financial Consultant from Financial Alliance Pte Ltd resigned. Edmond has been very helpful since day one. I don’t have the in-depth knowledge in economics and finances, hence require lots of hand holding and detailed but simple explanation from him so that I can choose the most applicable program that suits my needs

Edmond has been very patient, detailed oriented, super proactive and customer oriented at addressing all my enquires timely. I am grateful to have him as my Financial advisor and it’s indeed my greatest pleasure to recommend him for any corporate or individual who require the service.

Nancy Zhang, Client Services Manager

“I have been a client of Edmond for the past 12 years now, since 2009.

All these years, he has been assisting my family’s portfolio, including wealth protection and investment. He provides insightful information and comparisons to us, which helps us make sound and informed decisions.

He is a patient and dedicated advisor who knows his job well. He is accommodating to me and my family’s needs. If he cannot give me an answer right away, he will always come back with the right information.

Above all, he is always reachable by phone and patient regardless of any situation that I face. This is something priceless, that sets him apart from most other agents.

Without a doubt, i would HIGHLY recommend Edmond Goh to anyone.”

JR Tan, Coal Trader

Copyright © [Edmond Goh] — All Rights Reserved

Privacy Policy

Edmond Goh & PlanWithEd are part of Financial Alliance Pte Ltd.

This advertisement has not been reviewed by the Monetary Authority of Singapore.

By Edmond Goh

Financial Alliance Pte Ltd

150 Beach Rd. #12-01/08, GatewayWest, Singapore 189720